- Clinical Technology

- Adult Immunization

- Hepatology

- Pediatric Immunization

- Screening

- Psychiatry

- Allergy

- Women's Health

- Cardiology

- Pediatrics

- Dermatology

- Endocrinology

- Pain Management

- Gastroenterology

- Infectious Disease

- Obesity Medicine

- Rheumatology

- Nephrology

- Neurology

- Pulmonology

Medicare Part D Fuels Growth in Drug Spend

Health care spending in the United States increased 6.7% in 2006 to $2.1 trillion or $7026 per person. Prescription drug costs increased faster, up 8.5% to $216.7 billion from 5.8% in 2005, and were spurred in part by the launch of the Medicare Part D prescription drug benefit in 2006 (Cover Figure).

Health care spending in the United States increased 6.7% in 2006 to $2.1 trillion or $7026 per person. Prescription drug costs increased faster, up 8.5% to $216.7 billion from 5.8% in 2005, and were spurred in part by the launch of the Medicare Part D prescription drug benefit in 2006 (Cover Figure).

These findings are from an annual report compiled by Aaron Catlin, an economist, and other researchers in the Office of the Actuary at the Centers for Medicare and Medicaid Services and were published in the January/February issue of Health Affairs.

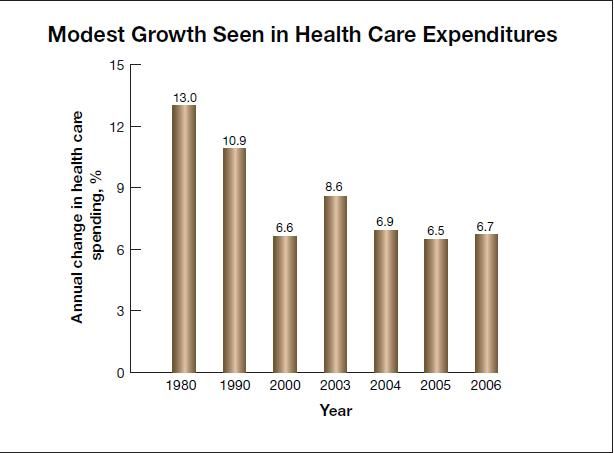

Growth in overall health care spending in 2006 was only slightly faster than the 6.5% rate in 2005 and has moderated in recent years (Figure 1), with slower growth seen in physician services, hospital services, and nursing home care. In 2006, growth in health care spending outpaced nominal gross domestic product (GDP) growth by 0.6 percentage point. Health care spending accounted for 16% of the GDP in 2006, up marginally from 15.9% in 2005 and 2004.

Figure 1. Growth in health care spending has moderated in recent years but according to some forecasts, the growth rate is likely to accelerate in the years ahead.

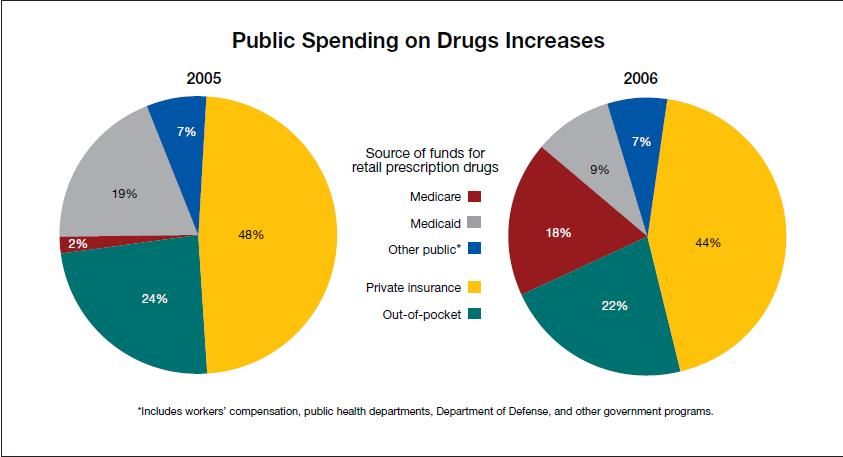

This year’s report reflects the impact of the first full year of Medicare Part D, which caused major shifts in the sources of funds used to pay for prescription drugs. As a result of Part D, the public share of drug spending increased from 28% in 2005 to 34% in 2006 with the private share showing a corresponding decrease from 72% to 66% (Figure 2).

Figure 2. In 2006, with implementation of Medicare Part D, drug spending shifted by 6 percentage points away from private payers to public payers.

The Medicare share of total retail prescription drug spending increased from 2% in 2005 to 18% in 2006. At the same time, Medicaid drug spending fell as a share of total drug spending from 19% in 2005 to 9% in 2006, causing the first ever decline in annual Medicaid spending (down 0.9%). This shift is primarily attributed to the automatic enrollment of 6.2 million persons dually eligible to be covered under Medicaid or Medicare from Medicaid into Medicare Part D plans. Both out-of-pocket and private health insurance spending as a share of total spending for prescription drugs fell, although actual expenditures increased.

The 2006 trend in prescription drug spending was influenced primarily by increased utilization. In addition to Medicare Part D, other factors cited as contributing to increased drug use include new indications for currently marketed drugs, strong growth in several therapeutic classes (ie, insomnia medications), and increased use of specialty drugs.

Moderating the drug trend was the increase in the generic dispensing rate to 63%, up from 56% in 2005.

In a perspective accompanying the Catlin article, Paul Ginsburg, PhD, of the Center for Studying Health System Change, suggests that the recent slowing of health care spending growth is unlikely to last. He cites 2 macro factors at work: continuation of the gap between health care spending growth and income growth, and increasing obesity prevalence contributing to future health care spending growth for conditions such as diabetes. While Ginsburg acknowledges the dampening effects of fewer blockbuster drugs and patent expirations on drug spending, he suggests that the impact of greater availability of generic drugs “will be increasingly offset by the rapidly growing use of specialty drugs.”