- Clinical Technology

- Adult Immunization

- Hepatology

- Pediatric Immunization

- Screening

- Psychiatry

- Allergy

- Women's Health

- Cardiology

- Pediatrics

- Dermatology

- Endocrinology

- Pain Management

- Gastroenterology

- Infectious Disease

- Obesity Medicine

- Rheumatology

- Nephrology

- Neurology

- Pulmonology

Consumers Seek More Services, Innovation From Health Care Providers

American consumers want more from the health care system than they are currently getting. They want to have online access to their primary care physicians (PCPs) and medical records. They also want greater access to wellness programs and alternative treatments.

American consumers want more from the health care system than they are currently getting. They want to have online access to their primary care physicians (PCPs) and medical records. They also want greater access to wellness programs and alternative treatments.

These findings are from the 2008 Survey of Health Care Consumers, which was conducted by the Deloitte Center for Health Solutions, based on a representative sample of 3031 adults in the United States.

Consumers access the health care system frequently. More than four-fifths (82%) of consumers surveyed reported having a PCP, and 92% of these say they visited their PCP in the past 12 months. Eighty-eight percent reported having some form of health insurance. Sixty percent say they currently take medications, and 20% say they use 4 or more prescription drugs; 15% had at least 1 overnight stay in a hospital in the past 12 months.

Consumers are generally satisfied with their physicians, hospitals, and health plans. On a scale from 0 (completely dissatisfied) to 100 (completely satisfied), average satisfaction ratings are 82 for PCPs, 75 for hospitals, and 70 for health plans. Physicians are viewed as the most trusted source of health-related information, while health plans are viewed as credible sources for nonclinical information. When asked how their relationship with their PCP could be improved, 31% of respondents said they would like to see service improvements, including more time spent with the doctor and shorter wait times. From hospitals, consumers are looking for more time and attention from staff.

Overall, consumers want access to more information and improved service, and they want their physicians to make better use of information technology. Nearly 80% of consumers want access to integrated medical records, while approximately three-fourths of consumers want physicians to provide online services to schedule appointments, exchange e-mail messages, and obtain test results (Cover Figure). One-fourth of consumers indicated they would be willing to pay extra for such services. More than half (56%) of consumers expressed interest in attending educational classes or meetings sponsored by their physician, while 17% were willing to pay extra for meetings to help them with a health problem, treatment approach, or recovery process.

Consumers also expressed strong interest in hospital services that assist consumers in choosing physicians, making treatment decisions, and managing personal health information. In addition to online access to an integrated medical record and informational Web sites, 51% of consumers would be interested in receiving assistance after a hospital stay from a patient representative to help them coordinate care with other organizations and caregivers.

“The findings convince us that Americans no longer see themselves only as patients but as consumers who want to take greater control of their health care,” said Paul H. Keckley, PhD, executive director of the Deloitte Center. “Consumers will redefine our health care market, but how they do it is the most important strategic question the health care industry must answer.”

Significant percentages of consumers say they have modified a treatment recommendation, used alternative modes of care, and sought information to assist in their health care decision making. Such consumer attitudes are typically derived from personal experiences. Many consumers seek out and use alternative services and therapies. One-fifth of consumers report treating a health problem with an alternative approach, such as acupuncture, chiropractic, homeopathic, neuropathic, or bio-electric therapies, with 40% open to doing so in the future. Twelve percent have consulted an alternative health care practitioner, and 38% might do so in the future. Nine percent have substituted an alternative or natural therapy for a prescription medication, and 32% might do so in the future.

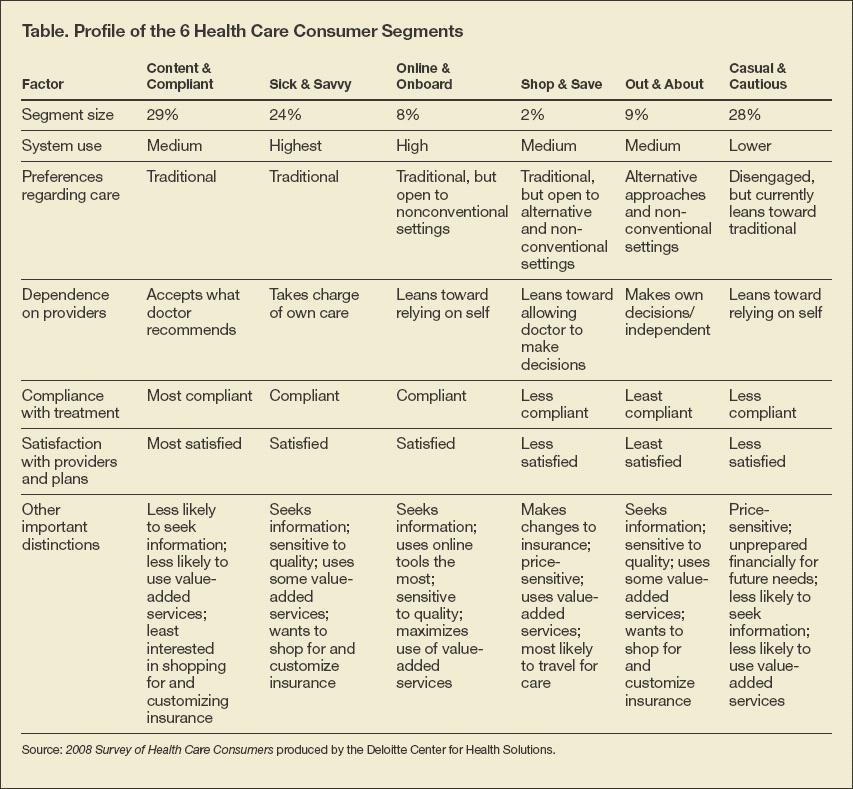

The researchers divide health care consumers into 6 groups according to attitudes and behaviors: content & compliant; sick & savvy; online & on board; shop & save; out & about; and casual & cautious (Table), suggesting that different approaches may be needed. Among those in the out & about group, there is much higher use of alternative approaches (49%), practitioners (37%), and therapies (36%).

Just under two-thirds (65%) of those who take prescription drugs say they fill almost all their prescriptions, and 83% say they nearly always take their prescription medications as directed. Thirty-four percent of those who take medications order their medications online or through mail-order pharmacies. Only 61% of consumers rate the safety and effectiveness of prescription medications as 70 or higher on a scale of 0 to 100. More than four-fifths (84%) of consumers say they would be more likely to choose a generic equivalent than a brand-name drug if given a choice.

Consumers are receptive to innovations such as retail clinics, online medication ordering, customized insurance programs, in-home monitoring, medical tourism, computerized personal health records, and wellness programs. Sixteen percent of consumers have used a walk-in clinic located in a retail setting. While just 13% currently use a monitoring device at home, 88% would be interested in using such a device if they had a condition that required regular monitoring. Nearly two-thirds (65%) expressed interest in participating in a wellness program sponsored by their employer or health plan, with interest increasing to 83% for programs in which participation is linked to reduced insurance copayments or premiums.

Underscoring the importance of health care, nearly four-fifths (79%) of those consumers surveyed say health care issues are likely to influence their vote in the 2008 Presidential election.

Phase 3 Data Support Oral Orforglipron for Weight Maintenance After GLP-1–Based Weight Loss

December 19th 2025Topline Phase 3 ATTAIN-MAINTAIN data show oral orforglipron met primary and key secondary endpoints for weight maintenance after prior GLP-1–based injectable therapy in adults with obesity.